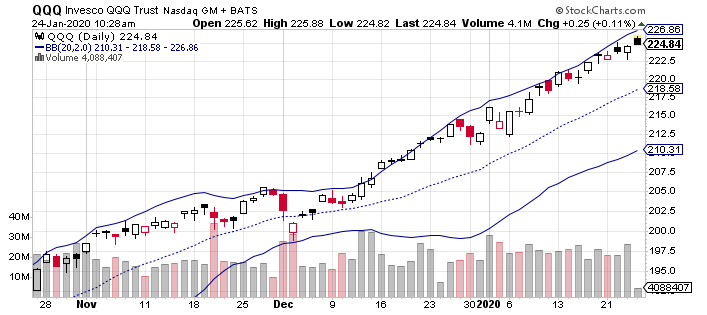

Nasdaq 100 Index & Bollinger Bands

What tends to happen when the Nasdaq 100 Index ETF (QQQ) closes above its Bollinger Bands (20)?

over the last 4 years when the QQQ closed above its upper band it has showed an AVERAGE GAIN of 0.12% on the next trading session (against 0.09% for any random day in that same period)

it happened on 62 trading sessions over that period;

the % of winning trades was 62%;

And what tends to happen when the Nasdaq 100 Index ETF (QQQ) closes below its Bollinger Bands (20)?

Well, the results got even more interesting:

over the last 4 years when the QQQ closed below its lower band it has showed an AVERAGE GAIN of 0.46% on the next trading session (against 0.09% for any random day in that same period)

it happened on 40 trading sessions over that period;

the % of winning trades was 58%;

This study shows in statistical terms how profitable it has been to buy the dip in the U.S. stock market indexes over the last few years.

(3-month QQQ chart from StockCharts.com)

Annotated quote: a superior form of trading

“Tracking your edge is relatively easy when you place several trades per day.” - – Brett Steenbarger, PhD

Why is that? Because you will be creating a large sample of trades to analyse every week, every month. But if your trading frequency is low (one trade per week, a few trades per month) then a longer period of diminished performance could go by and represent nothing more than a random bad sequence of trades or in other words, an unlucky streak. This is one of the reasons why I consider short-term trading and especially intraday trading to be a superior form of trading.

There’s more to life than trading

Weekend European football: I know I will be watching Valencia FC vs. FC Barcelona on Saturday. Barcelona has been shaky recently and the newly appointed manager is yet to impress. On Betfair, the odds strongly favor Barcelona with a win paying 1.69 against a fat 5.2 for Valencia to win. The draw pays well too, at 4.5.

Best sports play this week: If good trading is much about precision, what can we say about this play? I do not even know this sport but this is absolutely superb!

Talk to you soon,

Henrique

Disclaimer: Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence. Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't risk capital you can't afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.