Testing a Short-Term Technical Pattern on Apple (AAPL)

Testing a Short-Term Technical Pattern on Apple (AAPL)

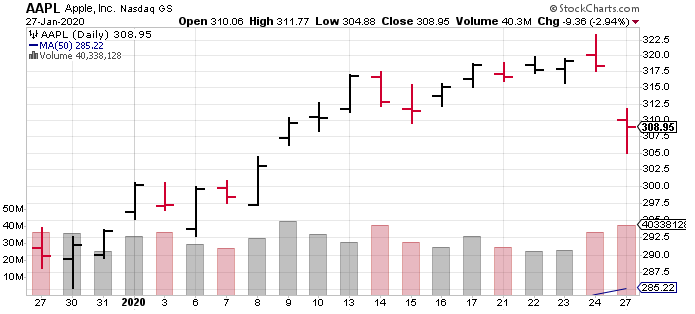

I ran a backtest on a very specific trading pattern on Apple (AAPL). My research usually starts with a question. Today the question was, how bullish or bearish are three consecutive closes above the previous day highs?

Interestingly this pattern as been showing a bullish bias over the very short-term. Here are the results for the last two years of price action:

the pattern happened twenty two times

the average gain for T+1 (next day close) was 0.44% with a win rate of 59%

the average gain overnight (next day open) was 0.25% with a win rate of 55%

(stockcharts.com)

PS: Trading Insights will be free till February 8. To keep getting all newsletters publications subscribe now.

Traders need a tested trading advantage

If you want to trade for a living or have an extra trading income to accumulate with your current profession, you need an edge (a tested trading advantage). This may sound a bit harsh, but if you trade without a proven trading edge, your sole purpose in the markets is to create liquidity for good traders to sell into. This is not what you are trading for, is it? As Steve Burns so wisely stated, “In trading, money flows from those with an opinion to those with an edge.”

Annotated quote: Mutating Like A Virus

“Skilled traders I have worked with have similarly been different traders in different markets.” - Brett Steenberger, PhD

Not every successful trader but most. One good example of this is found by reading the Market Wizards book. Many of those traders have evolved their methodologies and are now trading in completely different ways as we now have completely different markets. But for example, a successful eMini S&P futures scalper will always be a scalper and he may not need to make any meaningful changes to his approach.

PS: If you haven’t already read my book, Trading Course: How to Become a Consistently Winning Trader you can check it out on Amazon.

There’s more to life than trading

Today’s sports play: I picked Ilicic’s remarkable goal from the halfway line against Torino. What a beauty!

Recommended music: When I’m trading or doing market related research I am usually listening to good quality music. Today I’m sharing another one of my current favorites. I came across this track playing FIFA 18 with my son. :)

Talk to you soon,

Henrique

Disclaimer: Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence. Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't risk capital you can't afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.